Link land value tax to real interest rate in market to avoid land bubble

Land is a kind of real capital with near zero natural depreciation rate,

land value tax claimed by public department create artificial depreciation rate

When we invest, we need to balance between different productive inputs to maximize profit,

let production function Y(K1,K2,L1,L2....)

Py dY = Py Yk1 dK1 + Py Yk2 dK2 + Py Yl1 dL1 + Py Yl2 dL2

profit π= revenue -rents - depreciation

= (PyY) - (i K1 Pk1- i K2 Pk2- L1 W1- L2 W2) - (j1 K1 Pk1 + j2 K2 Pk2)

dπ= [Py Yk1 -(i+j1)Pk1] dK1 + [Py Yk2 -(i+j2)Pk2] dK2 + (Py Yl1 -W1)dL1 + (Py Yl2-W2) dL2

When profit maximizes,

[Py Yk1 -(i+j1)Pk1] = [Py Yk2 -(i+j2)Pk2] = (Py Yl1 -W1) = (Py Yl2-W2) =0

Pk1= Py Yk1/(i+j1), Pk2= Py Yk2/(i+j2)

it means that when market interest rate decreases, capital demand for investment increased,

capital price increased, real capital supply increase,

when K1 increase Yk1 also decrease, new equilibrium reached,

if Yk1,Yk2 not decrease much, price-interest elasticity would be

dln(Pk1)/dlni= d ln[Py Yk1/(i+j1)]/dlni=-dln(i+j1)/dlni=-i/(i+j1)=j1/(i+j1)-1

it says that when interest rate change,

lower depreciation capital increases more percentage of price

in the case of land in ancient days, when land price increase,

human cut woods & supply new lands to society,

but in modern days, near zero new land is supplied whatever land price expands.

When land supply is constant, marginal land productivity(Yk) is also constant to

real interest rate, and land depreciation(j) is near zero,

then land price(Pk) is inverted with interest rate(i),

price-interest elasticity: d ln(Py Yk/i)/d lni = -1

Because land investment don't increase real productivity in modern societies,

land price should be keep in a proper level, and we need to create artificial depreciation.

When public department charges tax to land owner, tax rate offers it.

What is the proper land value tax?

I think it would be tax rate = Jm - i

Jm: average capital depreciation (exclude land)

i: market real interest rate

In the world of insufficient effective demand, some goverment manage it

with money creation to make negative real interest, but most money

leaked to lands, it increases demand of poor, increases wealth of rich.

Its time to guide wealth of landlords to effective market demand.

(以下待續)

單財貨土地利用

若土地總量有限,以一定數量之產品為地租,每單位土地租金r,

土地邊際產量δY/δN 隨使用土地量N遞減 (上圖藍色曲線)

地租線與邊際產量線交點為土地需求,

當地租太高時,需求量小於土地總量,有閒置土地情形(上圖F點)

當地租太低時,需求量大於土地總量,有競租土地情形(上圖C點)

只有在E點的地租水準使土地供需均衡

若政府對地主收取地價稅(灰色部分),

地主則可以獲取地租與地價稅之間的差價成為地主利潤(淺綠色部分),

生產者利潤為超過地租部分之剩餘價值(淺黃色部分),

地價稅若超過地租將使部分土地閒置, 地主短期會虧本出租長期拋棄土地所有權

人口與勞動投入增加使土地邊際產量增加(藍線上移),

若稅率不變,地租上升,地主利潤跟著上升

但人口與勞動投入增加使單位勞力所分得土地減少,

勞動人均剩餘減少,地主利潤所佔比率上升

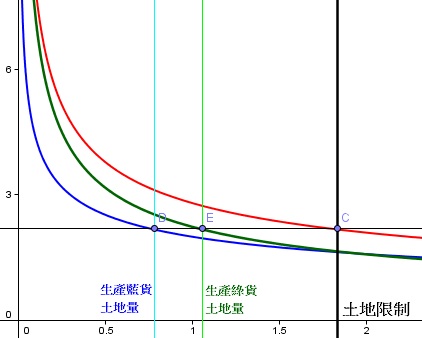

雙財貨土地利用

若土地總量有限,土地可選擇生產藍綠兩種財貨Y1,Y2,

藍綠工人不流動,產品市價P1,P2,

使用N1數量土地生產藍貨Y1時,土地邊際產值 P1 δY1/δN1 (上圖藍色曲線)

使用N2數量土地生產綠貨Y2時,土地邊際產值 P2 δY2/δN2 (上圖綠色曲線)

當土地邊際產值大於地租(每單位土地租金)時,生產者會租用更多土地直到相等時,

故任意地租水平下,該水平線與藍綠線交點為藍綠土地需求,

土地總需求為水平加總形成之紅線,

而土地總量有限,紅線與土地總量垂線相交處為均衡地租,亦為均衡土地邊際產值

當藍貨市價變原來兩倍時,土地發生重分配,

藍土地需求增加,綠土地需求下降,均衡地租與土地邊際產值上升

同理可知當藍綠貨市價同倍數上漲時,土地需求不變,但地租與邊際產值上升

GDP上升,但real GDP不變